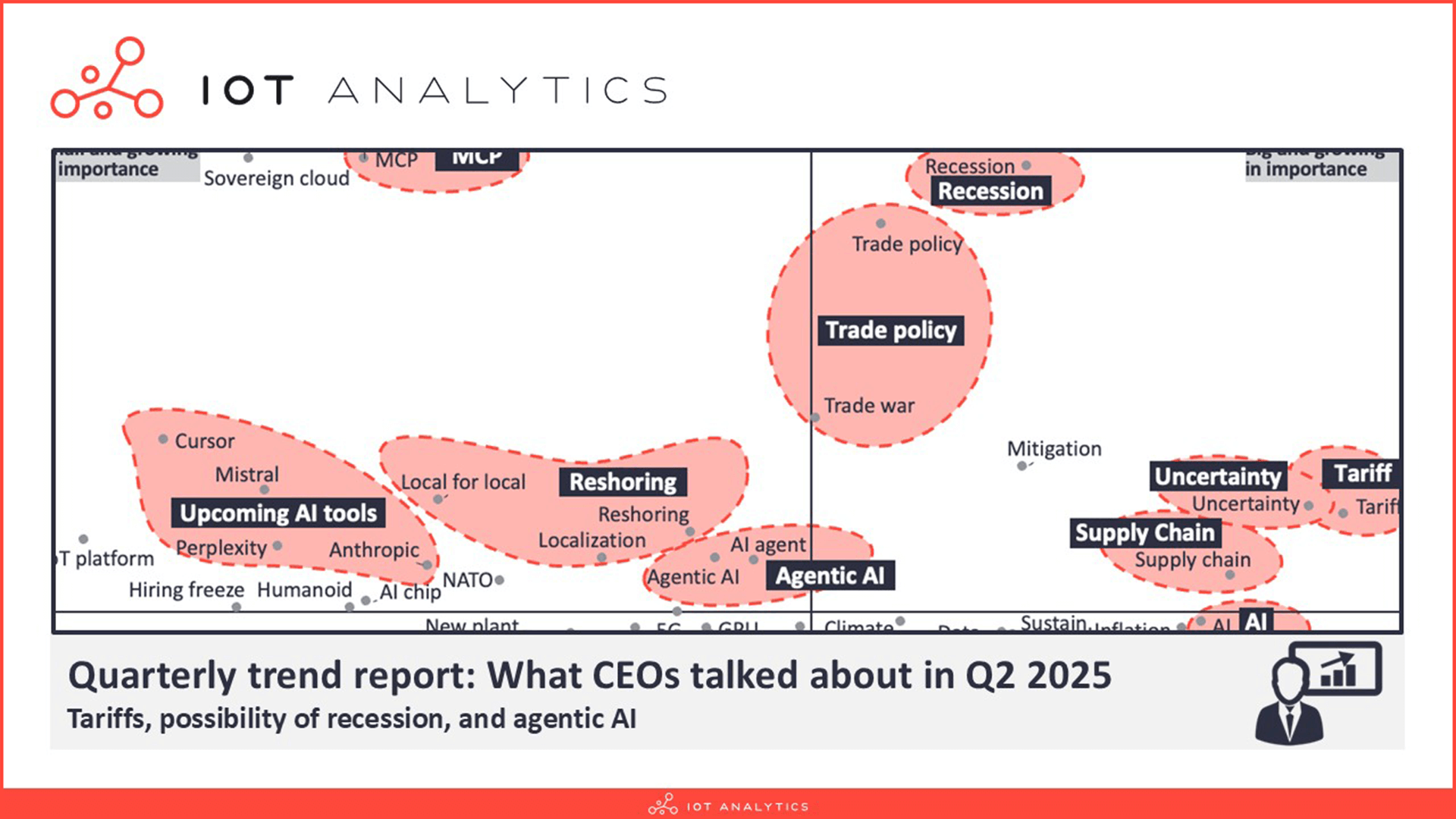

What CEOs talked about in Q2 2025: Tariffs, possibility of recession, and agentic AI

In short

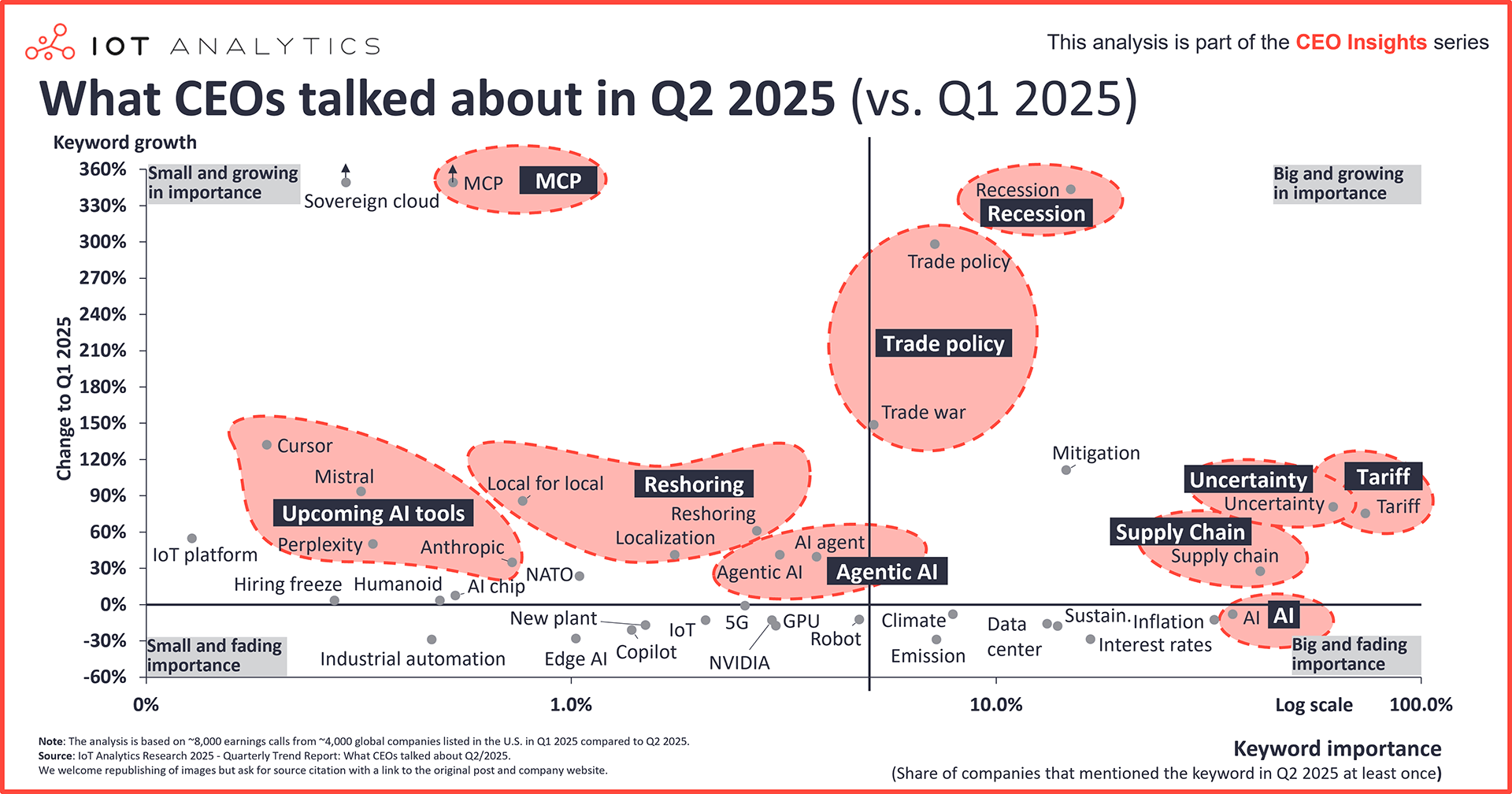

- According to IoT Analytics’ latest What CEOs Talked About report, 3 themes stood out in CEOs’ minds in Q1 2025: Tariffs, the possibility of recession, and agentic AI.

- Discussions about tariffs reached consecutive record highs in Q2 2025 as the US continued its trade wars with most of the world.

- Discussions around sustainability continued to decline, and general topics around AI (including infrastructure) declined.

Why it matters

- The prioritization of specific topics by CEOs may influence investment in these areas.

The big picture

The topic of tariffs reached its highest level of mentions. In Q2 2025, 3 out of every 4 earnings calls discussed tariffs, a 75% increase over Q1, according to IoT Analytics’ latest What CEOs Talked About Q2 2025 report. The report, which shares analyses of over 8,000 earnings calls from more than 4,000 US-listed companies between Q1 and Q2 2025, shows this is the highest level of mentions of the topic since Q1 2019, when IoT Analytics began tracking and analyzing earnings calls. This marks the second consecutive quarter that the topic of tariffs has reached record highs, with the previous highest level of mentions occurring in Q3 2019, when mentions peaked at 20% of earnings calls, indicating the level of consideration CEOs are putting into the topic.

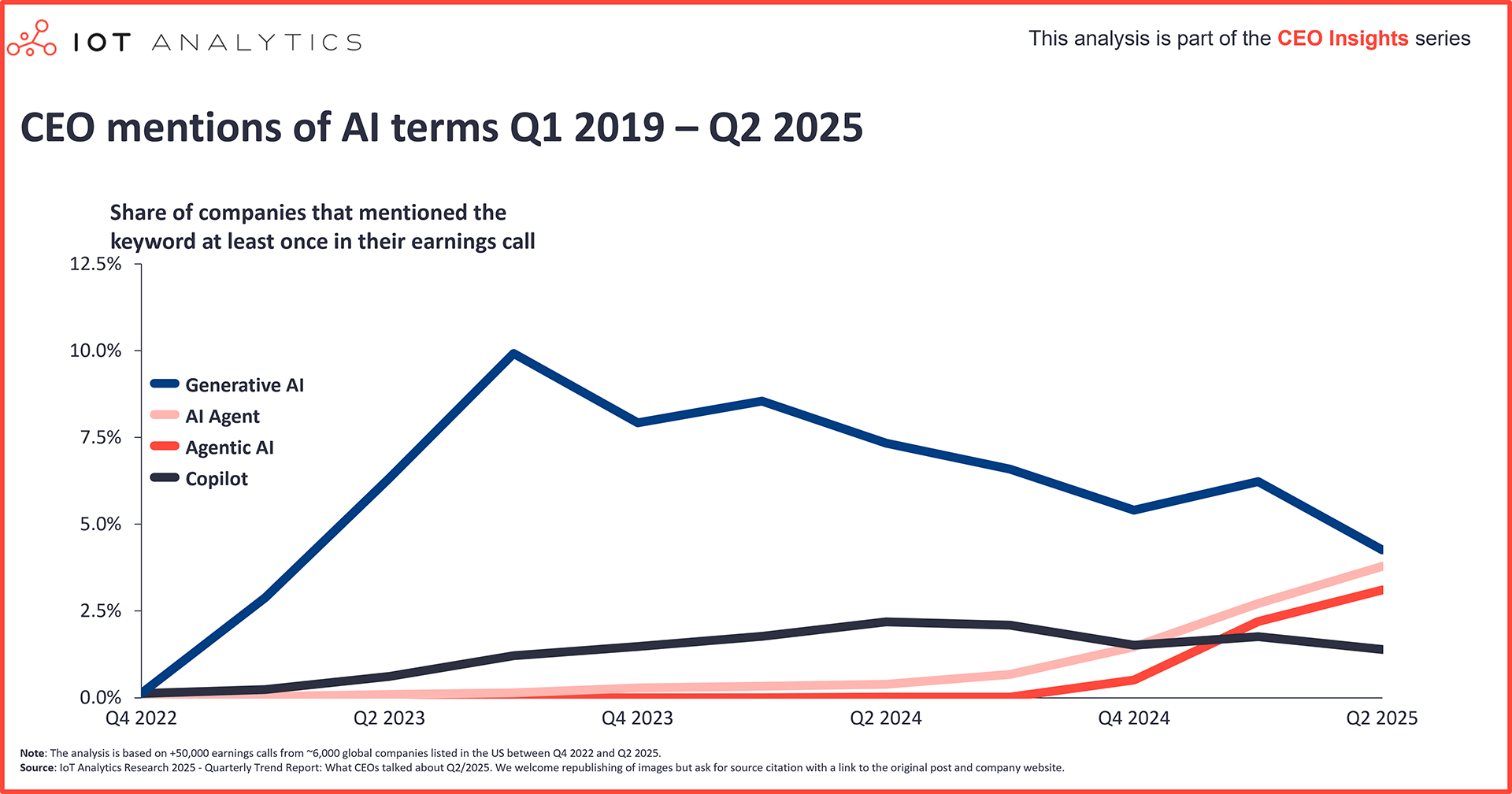

CEOs’ focus continued toward practical AI applications. Once nearing the #1 topic of CEOs, the general topic of AI and associated infrastructure (e.g., data centers and GPUs) experienced a decline, with AI dropping 8% QoQ in mentions. Meanwhile, specific AI topics, such as agentic AI, AI agents, upcoming AI tools (e.g., Cursor and Mistral), and the Model Context Protocol (commonly referred to as MCP), experienced a rise in Q2, continuing a trend of discussing practical organizational AI applications rather than just AI in general.

Insights from this article are derived from

Quarterly trend report: What CEOs talked about in Q2 2025

A 61-page report on the trends that emerged in Q2 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025.

Already a subscriber? View your reports here →

Key rising themes in Q2 2025

1. Tariffs

Tariff uncertainty reshapes corporate supply strategies. As mentions of tariffs reached new highs, the report notes 3 key themes that have emerged from these discussions:

1) Increasing uncertainty: Since the tariff situation is volatile and announcements keep changing, uncertainty is high. Ralf Thomas, CFO of Germany-based industrial automation company Siemens, noted that tariffs have added risk to further recovery in industries such as automotive and machine building. Uncertainty was a key rising topic in IoT Analytics’ Q1 2025 analysis of earnings calls.

2) Changing supply chain and localization strategies: Companies are trying to change their supply chains or produce more locally to avoid tariffs. Cathy Smith, CEO of international coffee brand Starbucks, noted that efforts were being made to shift merchandise production for this year’s holiday season from China to alternative sites. However, not everyone is eager to move. Benoît Coquart, CEO of France-based industrial group Legrand SA, shared that while it would be nice to relocate operations, the US’s low unemployment rate makes setting up industrial facilities not a simple task. Additionally, discussions around local for local (a strategy of focusing on serving immediate countries or regions) jumped 85% QoQ to 1% of earnings calls, with the basic materials sector seeing the largest increase (+227 QoQ to 3.6% of the sector’s earnings calls).

3) Increasing costs: Companies are concerned about how the tariffs affect costs. Christian Rothe, CFO of US-based industrial automation company Rockwell Automation, noted that the fastest mitigation of these costs was through pricing—a common reaction among many executives, according to IoT Analytics’ 50-page report The Evolving Tariff Landscape: Impact on the Economy and Businesses (published May 2025).

Key CEO quote on uncertainty

“We understand there are uncertainties and risks from the potential impact of tariff policies. However, we have not seen any change in our customers’ behavior so far. Therefore, we continue to expect our full-year 2025 revenue to increase by close to mid-20s percent in US dollar terms. We might get a better picture in the next few months, and we will continue to closely monitor the potential impact to the end market demand and manage our business prudently.”

C.C. Wei, CEO, TSMC, April 17, 2025

Key CEO quote on geographical footprint

“We invested in localization and supply chain resiliency and this largely balanced the tariff situation. While we have reflected the remaining risk, which we quantify a low double-digit euro million cost, we are confident that we can mitigate the remaining part, mostly via supply chain optimizations.”

Belen Garijo, CEO, Merck KGaA, May 15, 2025

Key CEO quote on increased costs

“For the June quarter, currently, we are not able to precisely estimate the impact of tariffs as we are uncertain of potential future actions prior to the end of the quarter. However, for some color, assuming the current global tariff rates, policies, and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add $900 million to our costs.”

Tim Cook, CEO, Apple, Inc., May 1, 2025

2. Possibility of recession

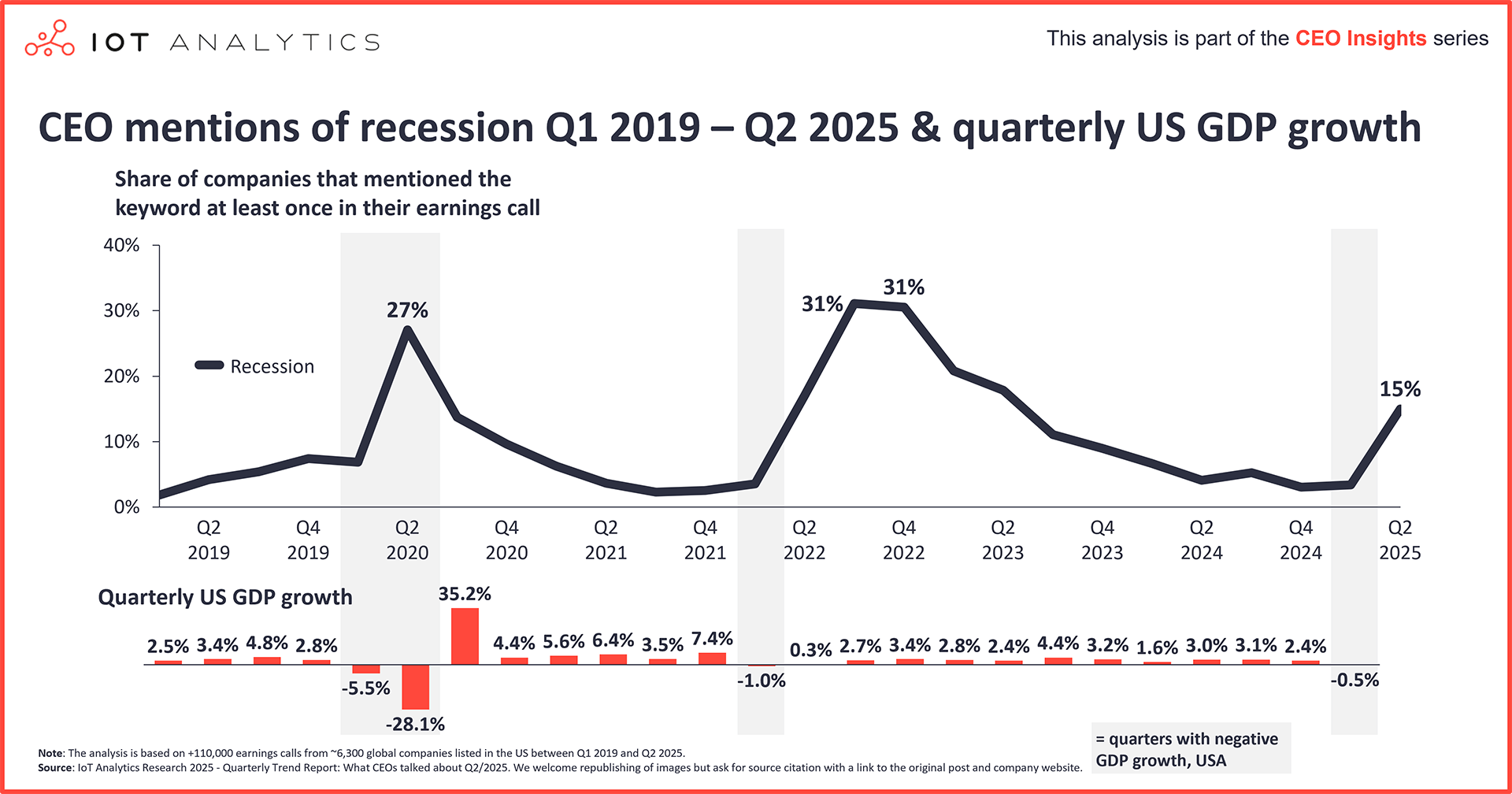

Recession mentions surged amid tariffs and negative US economic data. Discussions about recession rose 343% QoQ to 15% of earnings calls. Analysis in the What CEOs Talked About Q2 2025 report of earnings calls from the last 6 years shows that such climbs for this topic coincide with periods of negative economic growth in the US. In Q1 2025, the US’s GDP shrank 0.5% (a revision over earlier estimates), continuing this trend.

Executives downplayed recession fears despite tariff uncertainties. The report also notes 2 key themes in Q2’s discussions:

1) Recession appears unlikely: Most executives do not expect a recessionary economy; however, many view that the uncertainty around the tariffs has increased the chances of a recession. Ted Pick, CEO of US-based investment bank and financial services company Morgan Stanley, noted that economists are telling the company that the risk of recession has increased, but the general consensus is that there will be softer, rather than negative, growth.

2) Companies assure investors: Companies, such as US-based automotive manufacturer Polaris and US-based internet domain registry and web hosting company GoDaddy, are assuring analysts and investors that they are either prepared or in a good position in case of a recession.

Key CEO quote about the likelihood of recession

“Needless to say that the rapid unwinding of decades of productivity gains driven by the benefits of globalization in the context of an escalating trade war would likely result in a severe global recession.”

Dominik Asam, CFO, SAP SE, April 25, 2025

Key CEO quote about their company’s position if a recession were to occur

“We’ve implemented our recession playbook focused on cash preservation and liquidity. We decided to implement this operating model as our industry has been in a prolonged downturn, coupled with uncertainty around tariffs and consumer health. We’ll continue to monitor the evolving environment and adapt our approach accordingly.”

Mike Speetzen, CEO, Polaris Inc., April 29, 2025

3. Agentic AI and AI agents

Agentic AI continued rise in CEOs’ minds. CEOs in general increased their discussions about agentic AI (+39% QoQ to 3.8%) and AI agents (+41% QoQ to 3%). Although at times seemingly used interchangeably during calls, AI agents are software specifically designed to perform specific, perhaps repetitive, tasks, while agentic AI is a broader framework that enables systems to learn, adapt, and make decisions with limited human supervision.

Companies anticipated productivity gains from agentic AI deployment. The analysis in the report notes 2 key themes in corporate discussions around agentic AI and AI agents:

1) Efficiency gains: For example, US-based electronic design automation company Synopsys CFO Sassine Ghazi noted during the company’s Q2 earnings call, “Agentic AI will transform engineering workflows, allowing R&D teams to focus on important architecture and design decisions.”

2) Demand: During US-based hyperscaler Oracle’s Q2 earnings call, CEO Safra Catz stated that, due to AI agents, she expects the growth rate of cloud applications to accelerate over the coming year.

CEOs discussing these topics often noted first successes in increasing efficiency by deploying agentic AI in their organizations. Vendors of cloud computing, services, and applications also discussed positive early reception of agentic AI and appeared to see long-term demand.

Key executive quote about efficiency gains through agentic AI

“We are lowering cost-to-serve by centralizing tasks in hubs through digital delivery, automation, and the deployment of agentic AI.”

Coram Williams, CFO, Adecco Group AG, May 10, 2025

Key CEO quote about agentic AI being in high demand

“The market is increasingly receptive to AI agents, and we are strategically positioned to save this growth opportunity. […] We already successfully executed numerous projects on agentic AI by leveraging AI agents, we can achieve hyperautomation of complex variable processes that were previously beyond the reach of traditional data RPA or conventional AI methods.”

Aiman Ezzat, CEO, Capgmeni, Inc., April 29, 2025

Coincidentally, CEOs also discussed some of the upcoming AI tools at a higher rate as well:

- Cursor: Mentions of this AI-assisted integrated development environment (IDE) Cursor rose 132% QoQ to 0.2% of earnings calls.

- Mistral: Mentions of French-based AI startup Mistral and its eponymous line of large language models (LLMs) rose 93% QoQ to 0.3% of earnings calls.

- Perplexity: Mentions of AI-powered search engine Perplexity (powered by common LLMs like GPT-4.1, Claude, Gemini, and Grok) rose 50% QoQ to 0.3% of calls.

- Anthropic: Mentions of US-based AI startup company Anthropic rose 35% QoQ to 0.7% of calls. It is worth noting that mentions of Anthropic’s Model Context Protocol (commonly referred to as MCP) rose 2,476% QoQ to 0.5% of earnings calls.

Declining themes in Q2 2025

1. Sustainability

CEOs’ sustainability focus continued downward trend. Discussions around sustainability declined 18% QoQ to 14% of earnings calls in Q2 2025, continuing a general downward trend since its peaks of 27% of earnings calls in Q1 2021. Related topics also declined:

- Emissions: Down 29% QoQ to 7% of earnings calls.

- Climate: Down 8% QoQ to 8% of earnings calls.

This does not necessarily mean that companies are abandoning or losing interest in sustainability initiatives; however, it does indicate that the topics of sustainability and the environment are becoming afterthoughts in CEOs’ minds as the world experiences ever-warmer temperatures and questions regarding the sustainability of energy-hungry data centers that power the AI applications gaining in mentions, like agentic AI, linger.

Key CEO quote about the state of corporate sustainability strategies

“We are seeing subdued demand, particularly in the U.S., where investors remain cautious about launching sustainability strategies and funds.”

Andy Wiechmann, CFO, MSCI, Inc., April 22, 2025

2. Broader, more general AI topics

Executives shifted AI focus toward specific applications and tools. Discussions around general AI and often-associated topics experienced declines in Q2 2025 as AI applications like agentic AI and AI tools took on more focus:

- AI: Down 8% QoQ to 36% of earnings calls.

- Data center: Discussions around these AI powerhouses dropped 16% QoQ to 13% of earnings calls.

- GPUs: Discussions around the data center- and AI-powering chips dropped 18% QoQ to 3% of calls.

- NVIDIA: The company, often included in discussions around AI and data centers as the leading GPU company, was mentioned 13% less QoQ (3% of earnings calls).

What it means for CEOs

5 key questions that CEOs should ask themselves based on the insights in this article:

Below, we discuss how executives of industrial companies, in particular, address some of the above themes and how industrial companies differ from the rest.

- Tariff impact: With tariffs being the most discussed topic among CEOs, how should we adjust our pricing strategies, supply chain setup, and sourcing decisions to minimize risks?

- Recession preparation: Given ongoing macroeconomic uncertainty and increasing discussions about recessions, are we prepared for a potential recession?

- Trade policy: Governments worldwide are engaged in ongoing negotiations on trade agreements and tariff arrangements. Are we monitoring the decision-making process and preparing for various eventualities?

- Agentic AI readiness: As agentic AI gains traction, is our organization equipped to integrate these capabilities into our business processes, and how do we differentiate from competitors in AI adoption?

- Decreasing sentiment: With global sentiment declining, are we prepared to support our customers and business partners in addressing their specific pain points?

Focus: Industrial companies – What CEOs prioritized

Below, we discuss how executives of industrial companies, in particular, address some of the above themes and how industrial companies differ from the rest.

Access Insights+ for $99/month per user

Our Insights+ subscription is an extended version of our blogs that provides additional exclusive insights derived from our reports.

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about What CEOs talked about?

Insights from this article are derived from

Quarterly trend report: What CEOs talked about in Q2 2025

A 61-page report on the trends that emerged in Q2 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025.

Already a subscriber? View your reports here →

Related articles

You may also be interested in the following articles:

- How CEOs are reacting to tariffs: Pricing, financial guidance, and operational footprints

- What CEOs talked about in Q1 2025: Tariffs, rising uncertainty, and agentic AI

- The top 10 enterprise generative AI applications – Based on 530 real-world projects

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

Related publications

You may also be interested in the following reports:

- The evolving tariff landscape: Impact on the economy and businesses

- State of IoT Spring 2025

- List of Generative AI Projects 2025

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Leave a Comment